As a preface to this newsletter, I wanted to be clear on what my goals are and what these weekly posts will entail. I am using this newsletter as a way to document my journey of learning the process of real estate investing, and basically dump all the information I have learned into this funnel. I am in no way trying to act as a “guru” or mentor. I am most likely in the same boat as a lot of you reading this, and I think that brings a lot of value. Most investing blogs and videos are all about those that have done it already and are at the top. I want this to be more relatable to the average person who wants to get started, and can follow along with my wins and losses!

For this weeks newsletter i’m going to share my experience I had last week while I was up in Vermont looking at investment properties to purchase. I learned a lot, made some pretty big mistakes, and was really able to dial in my process for submitting offers.

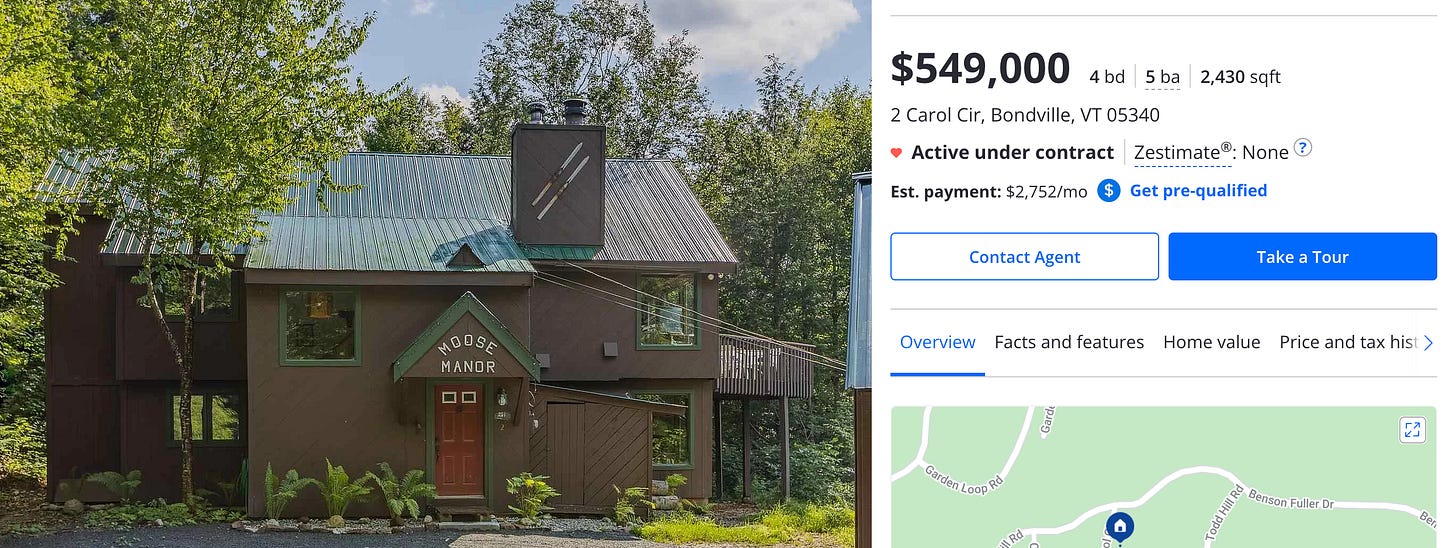

The property I was looking at to purchase (above) was the first Deal of the Week I did a while back, aka “Moose Manor”. It was an awesome cabin propped up on an acre of land with beautiful mountain views. I ran the numbers a million times, took a tour of the cabin twice, spoke with my realtor, and finally felt confident that this was a good choice for a rental property. In today’s market, you almost always have to offer over asking if you even want a chance at getting your offer accepted. However, Moose Manor had been on the market for about 2 months now, so we knew we could get away with a below ask price. I met up with my business partner and we talked numbers for a while, ultimately deciding that an offer of $525,000 was what we were willing to do. The listing price was $549,000, but with the condition of the home, and multiple days on market this was still a solid offer. We relayed this info to our realtor, got the offer written up, and submitted it promptly. Now we wait.

About an hour later, we heard back from our realtor explaining that the sellers needed a pre-approval letter from us to take the offer seriously. Now, as a quick side note, this offer on Moose Manor was the highest price point we had been looking at since starting our rental property search. Prior to this, every house we looked at was in the $250,000-$400,000 range and I had personally gotten a pre-approval letter that supported this price point. But after getting beaten out on about 5 offers by people coming in with 100% cash offers, my partner and I decided to raise our price to (hopefully) avoid those cash buyers. However, what we forgot was that my pre-approval was only up to $400,000, and Moose Manor was over $500,000. So when the sellers asked for a letter, mine was useless. I told my partner that he needed to get a pre-approval ASAP so that we could get on with this offer and get it accepted (since we were the only offers Moose Manor received). We reached out to lenders for the rest of the day, and finally got a hold of someone who could help us, but couldn’t process the letter until the next day. No big deal right? We’re the only offer on the house, we have nothing but time! Boy were we wrong.

As we are winding down in the day, and planning on submitting our pre-approval letter the next day, our realtor calls us and tells us another offer just came in out of nowhere. The offer was lower than ours but had all the paperwork needed. Long story long, the sellers accepted the other offer, denied ours, and we lost Moose Manor within a matter of hours. Well shit. Safe to say we were super bummed out. We really thought this was the one, and the last thing we expected was to get beat out by an offer that was lower than ours!

This is a reader-supported newsletter. Both free and paid subscriptions are available. The best way to join the community and support my work is by taking out a paid subscription.

The Mistakes we Made

During this entire offer process, there were a few mistakes we made that seemed so insignificant at the time, but in reality, cost us everything. The first mistake, and biggest one, was not having a sufficient pre-approval letter ready beforehand. It went right over our heads, because this was the first property we were interested in that was over our original price range of $400,000. Had we received that pre-approval letter beforehand, I think we would currently be in Moose Manor, getting it ready for renting. The second mistake we made was taking our time before even submitting the offer. Because the home had been on the market for 2 months, in a real estate market where most houses are gone in 2 days, we had a false sense of timing during the offer process. If we would’ve just gotten the offer submitted one day earlier, while still having the pre-approval debacle, we would have had everything submitted (and most likely accepted) before the new offer was even proposed. This was a hard pill to swallow, but it is safe to say we will never make these two mistakes again.

What was Learned

While these mistakes listed above cost us the purchase of a solid rental property, it also taught us lessons that we will never forget. Number one: get your pre-approval letter RIGHT AWAY, no matter what. You shouldn’t even be seriously looking at homes unless you have a letter in hand, ready to go along with your offer. Lesson number two: no matter the state of the market, or the strength of your offer, if you are lazy or slow to submit everything, there is a high chance someone will come in with everything needed and steal your deal. There’s a reason the phrase “time is of the essence” is so significant in real estate. If you aren’t moving quickly, and have all of your ducks in a row, you’re not going to get the deal you want.

The Positives

While I am upset that we lost out on this deal, there is still good that came from all of this. I went right to work with my partner getting a new pre-approval letter, and I wrote up a whole two page investment strategy checklist including everything we need to have checked off BEFORE we submit another offer. So yeah, we lost the Moose Manor deal, but ultimately, we are now even more prepared, and ready for the next property that comes to market. And when that next one does pop up, we will be able to move on it quickly and efficiently, hopefully resulting in an accepted offer and a future money making rental property!

Buying Your First Rental Property by Bigger Pockets

I hope you all enjoyed this weeks newsletter and took something away from it that you didn’t know before. As always if you enjoyed, feel free to share this with someone you know might be interested. You can also subscribe below if you want an extra newsletter every week that shows a full “Deal of the Week” analysis where I pick a property to analyze from start to finish!

Damn!!! Better one is coming!!!❤️